What impact will Russian aggression against Ukraine have on your digital use? Given the resulting displacement in energy supply, probably a lot. Everything we do on our phones, tablets, and laptops involves a network of fortressed buildings around the globe, called the data center. Inside the data center sits racks of computers called servers, upon which powerful algorithms run, so we can best live our lives in this digital world. Beyond the obvious space capacity limitations, each data center operator has to purchase enough energy to power these mighty operations, to keep the facilities cool, to ensure optimal performance. Who will absorb these increased costs? Will the data center operators pass on these costs to firms who lease space inside the data center? Will they in turn pass these costs on to consumers? Who’s in a stronger position to manage their p&l performance?

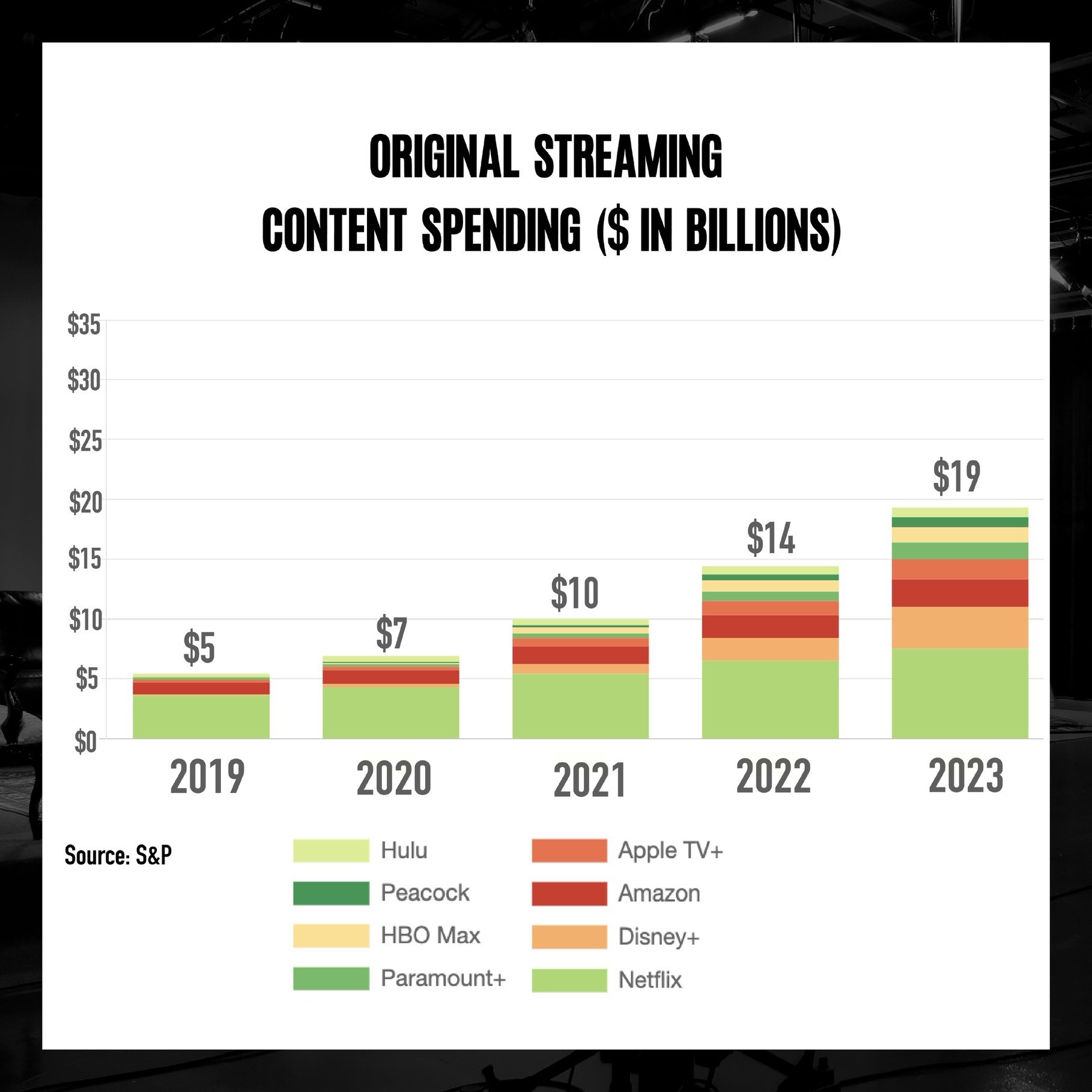

In a report issued in December 2020, the global data center power market was forecast to grow from $19.1 billion in 2020 to $26.1 billion by 2025. This on new data center construction globally to meet storage demand, and on the unprecedented rise in power consumption to support new cutting edge technology, which has increased both operational and power costs. Global Data Center Power Market

Layer in the actual and projected rise in crude oil and natural gas, brought about by firmly united NATO country sanctions against non-team player Putin’s Russia, you can quickly see we’re going to have an expense problem. Swift NATO response to the February 24, 2022 invasion has resulted in member countries instituting crippling financial sanctions, including shutting down imports of oil and gas from Russia. The battle in Ukraine further disrupts the supply.

Goldman Sachs, who attributes their success to a very intentional team culture, has issued a report by their Commodities Research Team. As Russia and Ukraine supply 17% of oil and 11% of gas to the rest of the world, the energy sanctions hit will be painful. The impact will be greatest in Europe, particularly Germany, but will certainly be felt here in the United States. Russia and Ukraine supply three million barrels of crude oil a day. Goldman predicts the west can offset half of this by releasing strategic oil reserves, and relaxing sanctions in Iran and Venezuela. The remaining 1.5 million daily shortfall in crude oil will result in higher prices to reduce energy consumption, forecasted at a range of $125 – $175 per barrel in 2022. The April 1, 2022 price sits around $100, with the 52 week range at $57.63 to $130.501. Goldman Sachs Podcast Impact of Russian Invasion on Global Economy

Data centers are primarily powered by electricity, which are impacted by rising natural gas prices. According to the U.S. Energy Information Administration (eia), wholesale electricity prices trended higher in 2021 due to increasing natural gas prices. Our reluctance to date to address the major impacts of climate change have resulted in especially volatile storm and temperature conditions, which in turn puts pressure on prices. More on that here. Since the onset of the war, natural gas has risen from $4.79 on March 1 to about $5.60 on April 1, 2022. The 52 week range is $2.45 to $6.471.

The good news is that major data center providers like Equinix, who benefit from veteran and strategic thinking management, have made significant advancements in energy efficiency and sustainability innovation. In December 2021, the Clean Hydrogen Partnership announced EUR 2.5 million in funding, choosing seven companies – Equinix, InfraPrime, Rise, Snam, SOLIDpower, TEC4FUELS, and Vertiv, to develop low-carbon fuel cells to power data centers. The EcoEdge PrimePower (E2P2) project aims to provide economic and resilient prime power solutions for the data center environment. It is hoped this could also reduce carbon emissions from operations by up to 100%. Consortium to Lead Fuel Cell Development for Data Centers

In January 2022, Equinix announced its first Co-Innovation Facility (CIF) located at its Ashburn Campus in the Washington, D.C. area. This is part of a broader Data Center of the Future initiative. The CIF is a new capability that enables partners to work with Equinix on trialing and developing innovations to define the future of sustainable digital infrastructure. Equinix Joins Partners in Sustainability Innovation

Broadly speaking, Equinix has been engaged for some time in transforming energy efficiency. Since 2011, they have invested more than $130 million to reduce energy consumption within their data centers. Equinix Energy Efficiency The other major data center provider globally is Digital Realty. For information on their operations and sustainability efforts, read more here.

All that being said, with the clear acknowledgement that I’m a big Equinix fan who follows their financial performance closely, it remains to be seen how this current global energy firestorm will impact p&l performance in 2022.

Keeping it simple, I turn to the latest guidance provided by Equinix CFO Keith Taylor on February 16, 2022, a mere eight days before the invasion. Following Q4 2021 revenues of $1.706 billion and adjusted EBITDA of $788 million, Q1 2022 guidance informs a revenue range of $1.726 – $1.746 billion, and adjusted EBITDA of $781 – 801 million. FY 2022 guidance for revenue is projected to be $7.202 – $7.252 billion, adjusted EBITDA $3.307 – $3.337 billion.

Clearly there are many variables that will determine any forecast variances that may occur. If the energy cost scenario plays out as anticipated, I would expect that adjusted EBITDA will show unfavorable variances to forecast, likely starting in the second quarter. Even if the decision is made to pass on these increased costs, the timing of client contract renewals will affect this decision. I will look to the upcoming quarterly investor calls for guidance, and keep you all updated. Please join in the conversation and let me know your thoughts! Stay safe and be well!

Feature Image: Please enjoy my favorite digital photo of my amazing brother Geoffrey and I at Lady Gaga’s performance at the L.A. Forum in December 2017! Yes we are a very musical family! #DigitalMemoriesToLastALifetime

1 Data sourced from the Wall Street Journal.