Continuing in my series on mobile and internet technology, this month I take a look at Google, the internet and technology juggernaut that generated $75 billion in gross revenue and $16.3 billion in net income in 2015. Net profit margin was 22% and the effective tax rate was 17%. The stock closed 2016 at $793.02 with a market capitalization of $554 billion. Google takes pride in not being a conventional company. Their innovations in search and advertising have made their brand one of the most recognized in the world. Their core products, including Search, YouTube, the Android mobile operating system, the Google Play app store, Maps, the Chrome internet browser, and Gmail each have over one billion monthly active users. Google believes they are just beginning to scratch the surface. In 2015 they created a new public holding company named Alphabet, a collection of businesses, the largest of which is Google, as well as new businesses Verily, Calico, X, Nest, GV, Google Capital, and Access/Google Fiber.

Focusing on 2015 Google Websites revenue of $52.4 billion, at 70.2% of total segment revenue, up from 67.4% in 2013, the firm’s SEC filings describe this segment as advertising revenue on Search, Google Play, YouTube, Gmail, Finance, and Maps. While Google does not publicly report earnings by product line, Search, YouTube, the Android mobile operating system, including the Google Play app store, are the key product lines in this segment. For 2015, researching multiple sources of earnings estimates, including these two by eMarketer and Forbes, I estimate the breakout to be:

I should note that there is considerable debate about how much Android contributes to Google’s bottom line, with annual revenue estimates ranging from $300-$500 million to $1 billion, to as much as $31 billion, as recently claimed by Oracle in their lawsuit against Google. Oracle is suing Google for copyright infringement, for using its Java software to develop Android, without paying for it. Five years of litigation continues following a January 2016 U.S. Supreme Court ruling where Google lost in their effort to derail the case. Any settlement figure would be a function of this estimate, where it may be appropriate to include “Search” ad revenue. We’ll leave that decision to the copyright finance valuation team assigned to the case.

In the Search space, competition is fierce. Competitor Microsoft’s Bing market share continues to increase, at 22.3 percent in October 2016, compared to Yahoo at 11.7 percent, with Google still leading the pack at 63.6 percent. Considering that Bing was first introduced in May 2009, and that it also largely powers Yahoo Search, Microsoft is certainly gaining ground. Bing finally catching up to Google. U.S. Search Engine market share.

The biggest advantage Bing has over Google right now is their paid advertising platform. Bing is closing the gap by offering more niche advertising, and at lower prices. New functionality in the Ad Preview and Diagnostics tool is starting to turn Bing Ads into a major player in the paid search advertising world. It’s likely that more marketers will start using Bing Ads as an online advertising platform for budgetary reasons alone. If combined with more design, functionality, and visibility changes, Bing could start closing that gap between them and Google faster than ever before. Another increasing threat is in Europe where the European Commission has instituted new personal privacy provisions. Further, many European countries have launched legislative attacks on Google’s ambiguous privacy policy. This presents a significant opportunity for Bing to rise up and force Google out of Europe.

In the smartphone space, Google’s Android operating system is the hands down leader at 86.2% market share, compared to Apple’s iOS at 12.9%, according to the latest Gartner research. Android, which was launched in 2008, makes money for Google in two ways, advertisements supplied by Google shown on Android phones, and revenue Google takes from its mobile app store, Google Play, which some technology analysts predict will soon overtake the Apple app store. Google Play to overtake Apple App store.

Also, in 2013, Starbucks dropped AT&T to partner with Google to provide an improved WIFI experience to their customers. Google will also work with Starbucks at developing the next iteration of the Starbucks Digital Network to provide increased content. Interestingly, I should note that following a recent flurry of iOS 9.3 updates, the functioning of my Apple iPhone 6 has declined dramatically when connected to Starbucks WiFi. Starbucks Google partnership.

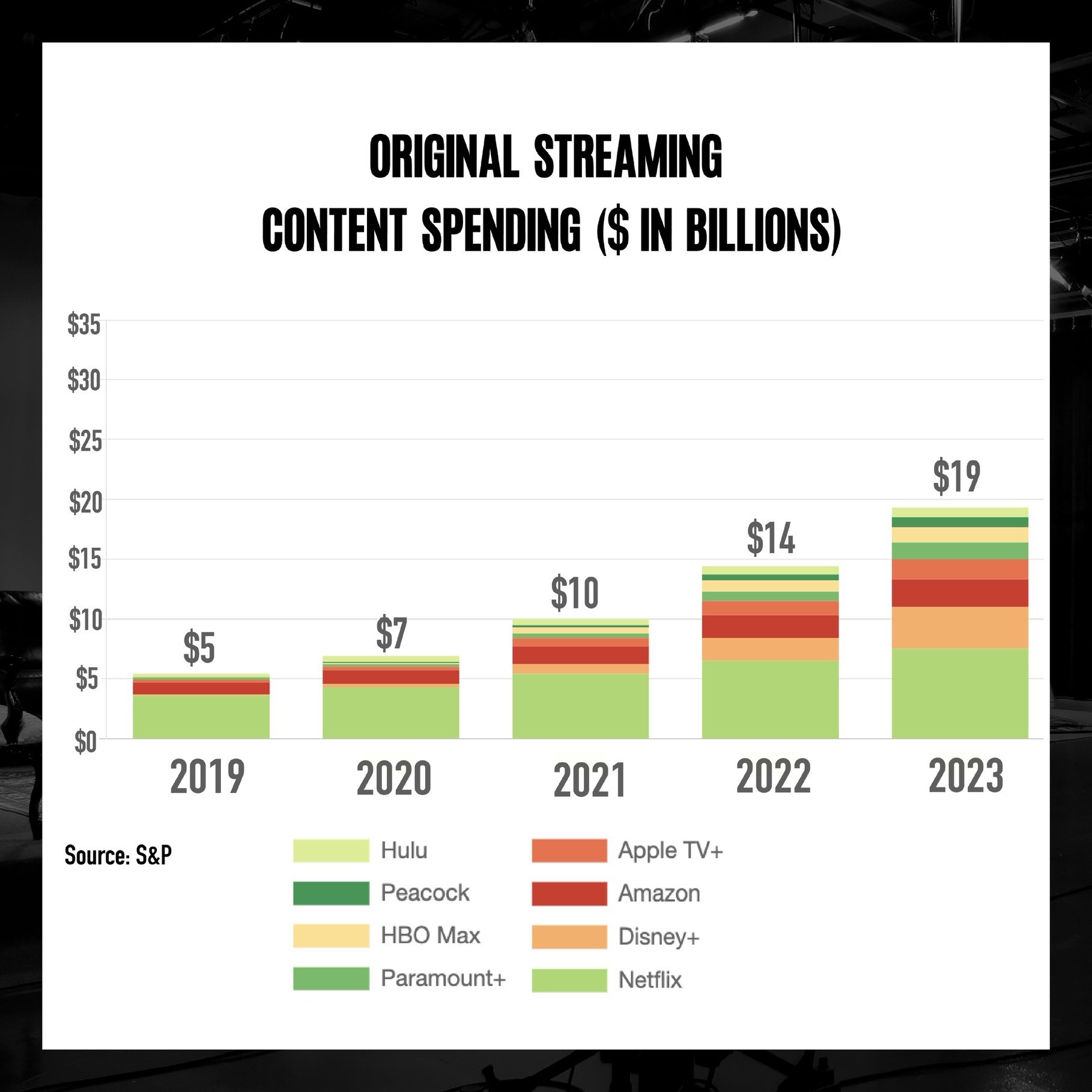

The final point of analysis, and of course near and dear to my heart, is the subject of music video and Google’s YouTube, which was estimated to gross $5.6 billion in revenue, and net $1.6 billion or 28.6% margin to Google’s bottom line in 2013. Advertising Age on Google’s YouTube. In the U.S. they were expected to net $1.08 billion, just 6.3% of all of Google’s net U.S. ad revenues for the year, but 20.5% of the $4.15 billion U.S. online video ad market. Forbes contributor Tim Worstall on Google’s YouTube. We can only rely on estimates as I noted earlier, in that Google does not publicly disclose financial results by product line. My 2015 gross revenue estimate for YouTube is $7.5 billion.

The P&L success of the YouTube advertising revenue model finds its roots in the Digital Millennium Copyright Act (DMCA) of 1998, the most important amendment to the U.S. Copyright Act of 1976; legislation enacted before user generated content sites like YouTube even existed, and clearly long before the significant transformation in digital technology we enjoy today. Google’s YouTube takes full advantage of the DMCA “Safe Harbor” provision that provides full protection from infringement liability for content flowing through their lines. To qualify, Google must meet certain guidelines, including promptly blocking access to newly discovered infringing material, and terminating repeat infringers. However, the responsibility for surveillance and enforcement lies with the Musical Artist, not with Google. Once a user uploads a video from a concert for example, probably without a license from the Artist, a global marketplace with at least five billion active users monthly, is instantly able to access this creative work for free. While Google’s YouTube is clearly not the only source of music piracy, the sheer global volume of the user base and ease of access to musical content, certainly makes it a major player. In the U.S., music piracy is a serious problem and results in the loss of $12.5 billion in total output annually, another $2.5 billion to downstream industries, the loss of 71,000 jobs, and $422 million less in U.S. tax revenue. The RIAA on the true cost of music piracy.

Further, Google’s YouTube is permitted to operate under an advertising revenue model, markedly different from a royalty based revenue model that has long been the standard in the recorded music industry. Musical Artists are in the fight of their lives! Multiple advocacy groups, including The Grammy Creators Alliance, The Future of Music Coalition, and the Berklee College of Music’s Rethink Music Initiative to name a few, are waging in earnest, a campaign for U.S. Copyright reform that reflects today’s music delivery system, that will protect Artists’ compensation, and that will ensure an enduring legacy of creative expression for years to come.

Looking abroad, in September 2016 the European Commission proposed modernizing copyright rules to help European culture flourish. The EU has adopted the Digital Single Market Strategy to offer better choice and access to content online and across borders, and to promote a fairer and sustainable marketplace for the creative industry. EU Press Release.

The winds are shifting and the message is becoming more clear. As the global recorded music industry is gaining legislative ground, particularly in the EU, and as consumer and music industry awareness and activism are on the rise, and as the Google YouTube development team has begun to respond with technology advances like Audible Magic and ContentID, expect to see transformative change in digital copyright law and protections, that will ultimately put some pressure on the YouTube profit model. Further, here is an interesting point if you’re really paying attention. Today’s technology graduates are more interested in the altruistic goals that silicon valley offers, like working on products that will change the world, as opposed to Wall Street, where attractive compensation packages apparently don’t carry the same level of gravitas. Talent wars: Silicon Valley vs. Wall Street. Then perhaps it’s not a stretch to say that these young grads will not want to play a role in the continuing erosion of the Artist P&L and musical creativity in our society.

Let me leave you with this thought. What value does music create in your life? Think about that first piano recital where your daughter was so excited to play Beethoven’s “Moonlight Sonata”; or that hard fought comeback to competitive gymnastics performing the floor routine of your life to Bill Conti’s “Theme From Rocky”; or the incredible emotion flowing at the debut reunion performance, twenty three years in the making, of a legendary and iconic Rock & Roll band! What about the pure joy and hope you feel when your very special and brilliant 55 year old brother writes his first set of lyrics to the “Twelve Days of Christmas” and then sings them to his girlfriend! Yes! “…take me down to the Paradise City.. yeah yeahah!” For those of us who cannot possibly imagine a world without music to fill our souls, with pure unbridled emotion and purpose that inspires us every day, our message is simple. We’re on it and we’re in it for the Artist! Count on it.

“Ten years ago they sent a machine from the future, “You Could Be Mine”