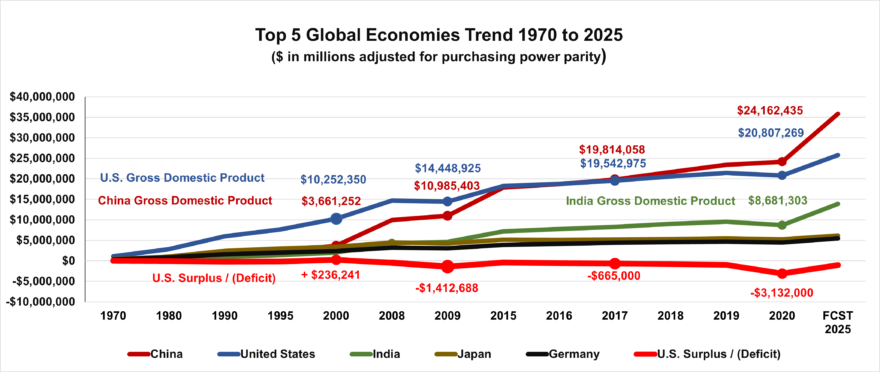

The United States of America is at an inflection point in the global economy, $20.8 trillion in 2020 to China $24.2 trillion. The dominant leader since WWII, the U.S.’s reign was first challenged in 2008 with the near collapse of the global economy. The first unprecedented U.S. bailout of $466 billion, in combination with a ($243) billion drop in gross domestic product (GDP) in one year, kicked off new levels of debt that, in the absence of transformative GDP growth, would be hard to overcome. JP Morgan CEO Jamie Dimon, in a keynote interview at the Wall Street Journal’s (WSJ) CEO Summit in early May, says the U.S. hasn’t experienced healthy growth in the last twenty years.

U.S. Treasury Secretary Janet Yellen, the second keynote speaker at the Summit, acknowledged that it took the U.S. almost a decade to get back on track following the 2008 financial crisis, and that we lost a lot in the process. So where are we now? After U.S. Debt to GDP hit 52.2% in 2009, it has risen further still to 71.9% in 2015, and 78.4% in 2019.

During that same period, China’s long term ability to recover and grow has exceeded that of its only serious competitor, the United States of America. After flirting with the top spot in 2009, China’s economy first took a small lead over the U.S. in 2017, then widened that in 2020. The International Monetary Fund (IMF) projects China’s economy will grow to $35.9 trillion by 2025, far outpacing the U.S. forecast of $25.8 trillion. GDP figures adjusted for purchasing power parity provide the true picture. India is in a distant third at $8.7 trillion, while Japan, Germany, and the top 10 European economies have barely moved, huddled under $5 trillion in 2020.

The COVID pandemic and America’s second unprecedented bailout and stimulus package totaling $6.2 trillion raised the ante again, bringing the United States debt level to $21 trillion entering 2021, exceeding GDP at a 101% total Debt to GDP ratio.

To be clear, economists will tell you that a 4% deficit to GDP annual spending ratio is normal. But that guidance takes on new meaning when you’ve experienced a 9.8% and 15.1% deficit to GDP spending ratio in two of the last twelve years.

China’s entry into the World Trade Organization (WTO) in 2001 changed the game. That, coupled with U.S. corporations’ short term profit focus, with increasing levels of service outsourcing and product importing, has put the United States of America in a position of catch up.

As the United States Trade Data Trends graph demonstrates, U.S. corporations have been betting against American ingenuity and talent since 1980, exporting services and talent overseas, and then importing resulting product. You could argue this strategy has worked well, as the Dow Jones Industrial Average (DJIA) has grown exponentially from $963.99 in 1980 to $30,606.48 to end 2020.

Multiple well respected business minds argue otherwise, and have been raising the alarms in recent years. The pressure for CEOs to deliver in the short term is significant. Outsourcing is a quick solution in a truly global world, where the rules are not all the same.

BlackRock’s Larry Fink led his 2021 annual address to shareholders expressing “steadfast commitment to long-termism”. This follows his 2016 letter to every Fortune 500 CEO, urging corporate leaders to “play their part by persuasively communicating their company’s long-term strategy for growth”.

In 2015, McKinsey & Company Global Managing Director Dominic Barton and Canada Pension Plan Investment Board CEO Mark Wiseman launched an initiative to promote a longer term focus in business, following a survey of 1,000+ C level executives and board members, where 79% said they felt pressure to deliver financial results in a two year time frame.

Bill Budinger, inventor, entrepreneur, founder & CEO of Rodel, Inc., a firm that manufactures electronics products, argues American investors are killing their golden geese, where planting has been replaced by harvesting.

Can we reclaim our intended position as economic leader of the free world? Absolutely! America is the land of dreams and innovation! But we have a lot of work to do, in areas that to date, have alluded us. This includes investment in education and training in manufacturing, and enduring development of STEM talent in segments of the population known to deliver, in particular women.

Ironically, timing of the COVID-19 pandemic recovery is in our favor. JP Morgan CEO Jamie Dimon believes we are at a near “Goldilocks” level of recovery, that will deliver fast growth with mild inflation. Janet Yellen agrees. We need to seize this moment and to coin a gymnastics phrase, we need to hit four of four routines.

We must invest where ROI potential is greatest! We can do that while also helping small business and people on the lower end of the income spectrum, who have been disproportionately hit by the COVID pandemic. Brilliant!

A great example of this is Goldman Sachs’ pledge of $10 billion to their “One Million Black Women” Initiative, launched in March 2021. They believe that reducing the earnings gap for Black women could create up to 1.7 million jobs and add $450 billion to U.S. GDP annually. This follows on Goldman’s long term recognition of the power of the purse of women broadly. Lloyd Blankfein, in a 2008 speech for their 10,000 Women Initiative had this to say. “When you get to the topic of trying to invest and create GDP, there is no better, more efficient investment, there’s no lower hanging fruit in the world to pick, than the investment you make in women.”

Further, many U.S. firms are leaning in on digital transformation and ESG initiatives, recognizing the serious ROI potential. It’s an exciting time where, not only do we have the opportunity to drive transformative innovation and restore balance on earth, but we can also restore broad based prosperity to the shrinking middle class, which after all, is the engine of the U.S. economy.

In 2016, following a decades long career in technology, most notably as the CIO of Verizon, Dr. Judith Spitz founded Break Through Tech at Cornell Tech in New York City, an initiative making headway increasing the number of women in computer science and tech careers. An article in the WSJ reports that STEM fields are some of the fastest growing and most lucrative. Increasing the number of women would likely have big implications for the economy.

Another great organization, Girls Who Code, founded by Reshma Saujani, and currently led by CEO Tarika Barrett, is doing important work in education, trying to close the gender gap in tech.

A recent Newsweek survey notes that more than 4.5 million fewer women are employed now than at the beginning of the pandemic, bringing the labor participation rate for women to its lowest levels since 1988. Some 44% of women who were unemployed in April 2021 have been out of work for longer than six months. We need to act on that! We need to action where GDP potential is greatest, if we’re serious about taking on China!

Turning to U.S. legislative initiatives, the likely to pass U.S. Senate led $190 billion Innovation and Competition Act, is intended to directly take on rising competition from China. It includes $100 billion for R&D and investments in emerging technologies where the country that leads, will have a significant advantage in the global economy. Artificial intelligence (AI), machine learning (ML), robotics, and high performance computing are critical areas of capability in practice today across the globe. We have to get out in front on this! And yes, unfortunately this is already impacting lower skilled workers who perform repetitive tasks. Investment in our workforce with education and training is crucial.

$10 billion has been allocated to the U.S. Commerce Department to establish at least ten regional technology hubs, intended to take on the serious talent shortage we have in U.S. manufacturing. It is estimated that 3.5 million U.S. manufacturing jobs will need to be filled in the next ten years, where the current U.S. skills gap will prevent 2 million of those jobs from being filled. This could cost the U.S. economy as much as $1 trillion.

A newer level of concern surrounds a study published in early May 2021 by Deloitte and the National Association of Manufacturers. It reports that while the COVID pandemic wiped out about 1.4 million manufacturing jobs, the industry has only been able to hire back about 820,000.

$52 billion has been designated to incentivize domestic semiconductor fabrication. Given the alarming 60 Minutes segment in early May, where we learned that Intel’s share of the market has dwindled to just 12%, and that the Republic of China’s Taiwan Semiconductor Manufacturing Company (TSMC) is producing chips that are 30% faster and more powerful than what we are able to make in the U.S, this is an area that requires intense focus and actionable strategy. Chips are integral to our way of life. Without them, we don’t use our phones or computers, and we don’t drive cars.

Everyone is in agreement on the value of investment in education and training, from the authors of the Penn Wharton Budget Model (PWBM) to Janet Yellen. Jamie Dimon offers some targeted perspective. He agrees that the Biden agenda is right on the issues, but that you can’t just throw money at them. You have to be specific with measurable outcomes. He made reference to his role on the New York Business Council where they’re trying to match education with jobs.

I recommend bringing together the Innovation and Competition Act’s $10 billion regional technology hubs plan with the $1.4 billion education investment piece of Biden’s American Families Plan. We need committed resource at community and four year colleges, working in direct coordination with these regional technology hubs, in direct coordination with regional employers in need of specific talent. Free college is only helpful if each and every student lands a job, that helps us drive innovation and GDP growth, in direct competition with China. Yes we need that level of actionable specificity.

We need to bring the supply chain back to America. Two words. PPE. Chips. Before the COVID pandemic, China based firms produced about 50% of the world’s PPE supply. One example where this really hurt us, follows a yearlong investigation by The Guardian and Kaiser Health. They found that 3,607 U.S. healthcare workers lost their lives to COVID in the first year. Many of these deaths were avoidable, with widespread PPE and mask shortages a contributing factor. That’s completely unacceptable!

Further, the U.S. is in an extremely vulnerable position with poor market share in the global semiconductor chip industry. How is that playing out right now? According to a May WSJ article, Americans are shopping for cars in near-record numbers, but the world’s computer-chip shortage has left dealers with the fewest offerings in decades, forcing auto makers to cut production of more than 1.2 million vehicles in North America. If you’re really paying attention, then you’ll recall the $80 billion auto industry bailout in 2009. What is the longer term ROI impact on that spend, given this current situation? It’s clear we need a broader focus across American industry.

We need to make investments in infrastructure, where we currently rank 12th in the world. We need specific focus on rail, water and the electric grid, and renewable energy where we rank 48th, 23rd, and 24th in the world respectively. Negotiations continue on Capitol Hill to reach consensus on a spending plan, with the Biden administration currently at $1 trillion to the GOP’s $928 billion. Sounds like we’re almost there!

We need to stop the global tax race to the bottom. The Washington Post reported on May 31 that the G-7 is set to support Biden’s minimum global corporate tax. While it’s early in the game, this is very encouraging news.

Please see graphs and article addendum below. I hope I’ve got you thinking! I’d love to hear your thoughts and questions!

I’d like to lead us out with this epic Rock&Roll ballad from the wildly talented, science minded Kiszka brothers. Here’s Greta Van Fleet with their newly released album The Battle At Gardens Gate. Out of silence, we will sing! Broken Bells

Graphs:

Addendum for your reference and knowledge:

McKinsey Dominic Barton Focusing Capitol on the Long Term

American Investors Killing Their Golden Geese

In the capital markets and technology space, check out these four firms leading on digital transformation and sustainability.

BNY Mellon Future First

Equinix Sustainability

Zscaler Zero Trust

CITI ESG

WSJ Women In Technology

Newsweek Pandemic Cost To Women

U.S. Innovation and Competition Act

Deloitte Manufacturing Skills Gap

PBS News Hour Cutthroat Global Competition For PPE

60 Minutes Semiconductor Chip Shortage

The Guardian U.S. Healthcare Workers Lost to COVID